I was watching

Good Morning America this morning (blame the wife, I

can't stand it), and I noticed they were discussing how the Dow Jones

Industrial was nearing 13,000 again while the NASDAQ was closing in on

3,000.

It got me pondering on the current discussion about where the

inflation rates currently sit on the CPI (sitting at

2.3%

right now). Many of the mainstream economists (Krugman, Baker,

Wiesenthal, etc) have touted the line that because of this ~2% inflation

rate, inflation isn't happening.

This is true in a sense.

What they

fail to realize is for all intents and purposes, the economy should be

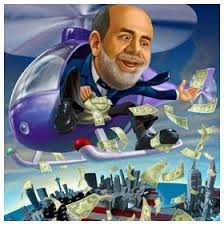

in a deflationary period but isn't because of the

massive amount of monetary expansion by the Federal Reserve.

Since the recession started in 2007, the Federal Reserve has

printed

$2.7 trillion dollar in two round of quantitative easing (buying US

Treasury bonds). On top of that, it has kept the Fed rate (the basis for

all interest rates) at historic 0.5%. These are the same policies

which led to the housing & credit bubble in the first place.

And it will have disastrous results in the future.

Because all this money is being pushed into the markets, the economy is incapable of removing the

enormous amount

of bad money (debt) it has in its system. Almost every aspect of the

market is inflated from the deflationary lows they need to be at a

sustainable rate. The Fed rate needs to be elevated much higher to

discourage the massive debt leveraging the Wall Street banks

participated in from 2001 - 2007.

This is why so many among the Austrian School

warn about inflation,

even though we are currently in a stagnant period. If the economy

recovers, the monetary expansion is going to rear its ugly head and

create a staggering amount of inflation, which will be nothing but

destructive for the average citizen, wiping out any savings in cash and

destroying wealth.

The mainstream economists and government policy makers are going

to be the end of the middle class if we do not wake up and start

protecting our wealth.

This article was originally published 2/21/12.

Follow me on Twitter: Jake_Collin.

Subscribe to The Rantin' Arkansan on the home page.